3 Months

Final year students, Graduates & Professionals with exp up to 3 yrs under 26 yrs of age

Avg. CTC: 2.5 to 3.5 LPA

Certification

- Reserve Bank of India : Evolution, Function & latest initiatives

- Risk Regulations in Banking Industry: Basel Norms

- Indian Banking Structure

- Non-Banking Financial Companies

- Important Institutions: NABARD, NPCI etc.

- Activity: Banking Structure

- To check attentiveness in a virtual Class

- Various Banking Customers

- Money Laundering

- Obligations under PMLA

- Obligations under International Agreements- FATF, FATCA & CRS

- Activity: Identifying client risk

- Important Deposits Terminologies (AMB/AQB, Home Branch/Non-Home Branch, Simple/ compound interest, ATM/ Debit Card, HNI Programs etc.)

- Demand Deposits (CASA)

- Time Deposits (FD & RD)

- NRE, NRO & FCNR a/cs

- Operational Aspects of Deposit Accounts: Joint Accounts, Nomination Facility, Inoperative Accounts & Unclaimed Deposits

- Insurance of Bank Deposits

- Case let based Role Play (Pitching of deposit a/c)

- Asset verticals in a Bank

- Important Retail Assets Terminologies ( LTV, Credit Burrous, NPA, Amortization Schedule, Fixed Rates, Floating rates etc.)

- Retail Assets Products: Home Loans, LAP, Gold Loans, LAP, Personal Loans and Consumer Loans, Credit Cards

- Case let based Role Play (Pitching of Retail Asset Product)

- Principles of Lending

- Working Capital and term loans

- Methods of Assessment of Loans

- Credit Management

- Credit Monitoring

- Forex Services in Banking

- Payment Systems in India

- Online Banking

- Cash Management Services

- Safe Deposit Lockers

- Merchant Banking

- Government Business

- Primary Markets

- Secondary Markets

- Structure and Participants of Stock Markets

- Trade Cycle

- Settlement Calendar

- Market Indices

- Important Equity Market indicators

- Equity Analysis

- Features of a Debt Instrument

- Risks in Debt Instruments

- Types of Bonds

- Principles of Bond Valuation

- Duration & Modified Duration,

- Debt Markets and Instruments

- Developments in Indian Bond Markets

- MFs- Meaning

- MF Vs Direct Equity Investments

- MF- Advantages

- Types- Open-Ended & Close Ended, Equity & Debt, Direct and Regular Plans.

- How to Invest in MF

- Case let based Role Play ( Open a Call for a MF)

- SEBI Classification of MFs

- Evaluation of an Equity Fund Scheme

- Evaluation of a Debt Fund Scheme

- Factsheets

- Case let based Role Play (Fund Recommendation MF)

- The Concept of Risk, Perils and Hazards- Classification of Risks

- Risk Assessment, Risk Transfer & Mitigation Methods

- The Concept of Insurance

- Principle of Probability and Law of Large Numbers

- Pooling of Resources-Sharing of Risks

- Insurance as Security / Solidarity

- Moral Hazard / Morale Hazard

- Adverse Selection

- Utmost Good Faith

- Insurable Interest – Material Facts

- Proximate Cause

- Indemnity –Valued Policy

- Subrogation

- Legal Characteristics of Insurance Contract

- Types, Life & General Insurance (Motor, Health, Mediclaim, Travel) Products

- Case let based Role Play (Pitching of Insurance Products)

- Introduction to Derivatives

- Forwards & Futures

- Options Terminology

- ITM, ATM and OTM Options

- Pay-off: Call and Put Options

- Hedging and Speculation with derivatives

- Derivative Markets in India

- Alternate Investments: Commodities trading, PMS, REITs, AIFs etc.

- Risk, Return and Asset Allocation

- Planning for financial Goals

- Ethics in BFSI

- Difference between a mistake & a fraud

- Examples of Miss-selling in BFSI

- Money Laundering

- Obligations under PMLA

- Obligations under International Agreements- FATF, FATCA & CRS

- Activity: Identifying client risk

Frequently Asked Questions

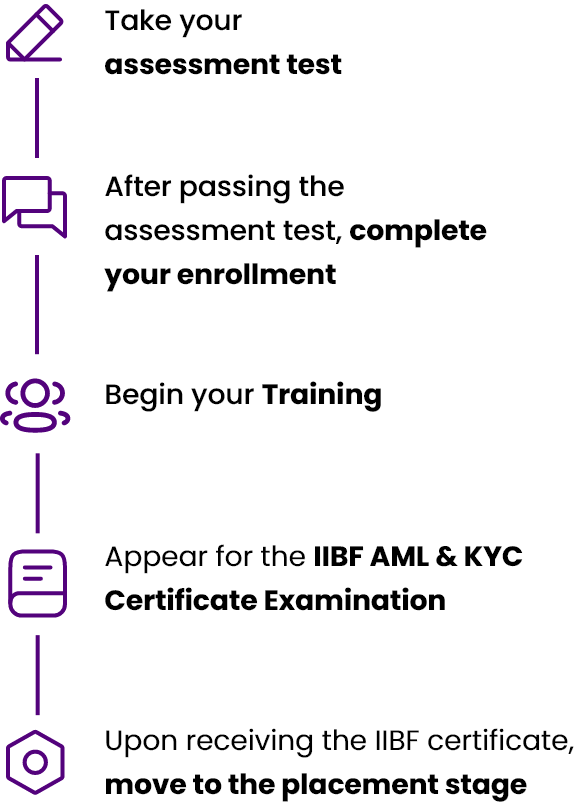

When you enrol for Expertrons PGCP BFSI, you will be receiving the following:

• Domain and soft skills training

• Upskilling through various capstones projects

• Expert calls

• Expert Referral reach outs

• Mock interviews

• Job portal access

Fees paid by the Aspirant are non-refundable.

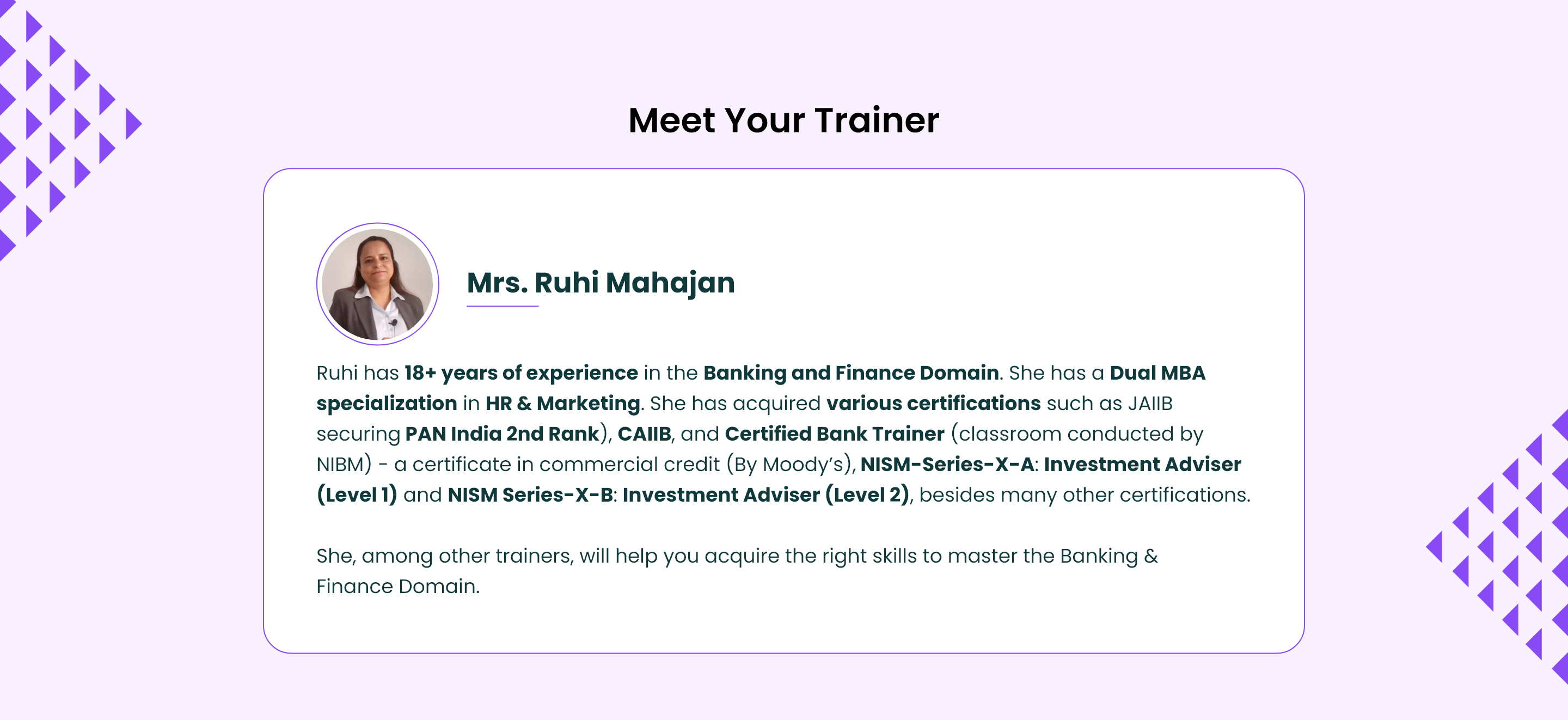

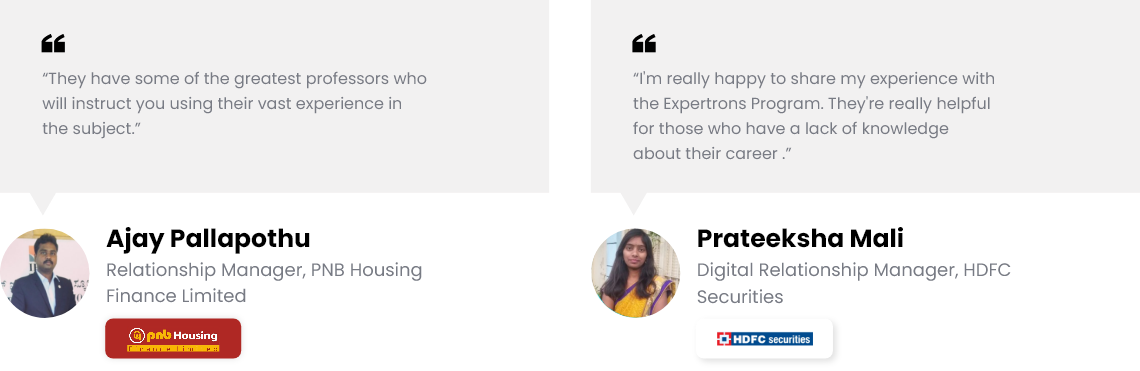

Expertrons is one of the most reputed Skill-tech companies in India. We provide a best-in-class curriculum created by leading faculty and industry leaders through videos, cases and projects, assignments and live sessions. At the end of the program, you will have cutting-edge knowledge of the Banking and Financial Services (BFSI) industry to help you land your dream career with our hiring partners and across the BFSI industry.

You become eligible to get into companies like Kotak Mahindra Bank, Union AMC, AU Small Fin Bank, Axis Bank, Motilal Oswal, etc.

Interviews will happen post-training completion.

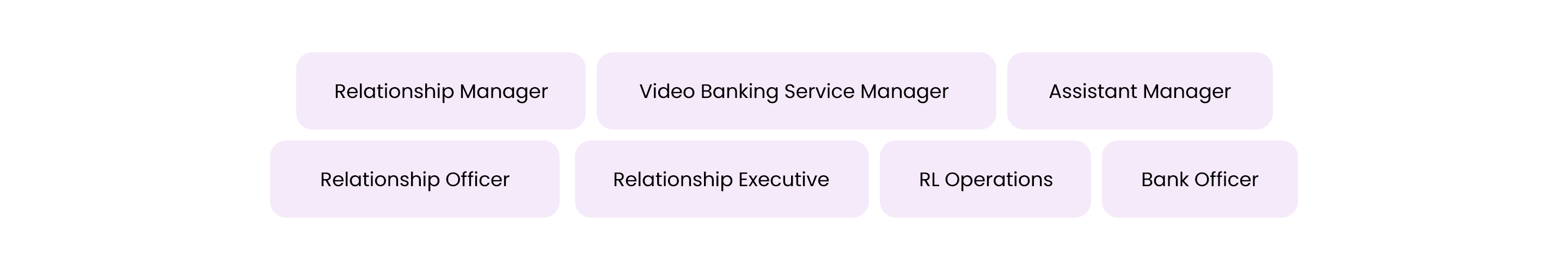

Expected job designations are Relationship Officer, Relationship Manager, Executive, RL Operations, Assistant Manager, Video Banking Service Manager, and Bank Officer.

The job location could be Pan India. So aspirants should be willing to relocate.